Like many flexible currencies, Capital One miles provide the highest redemption values when redeeming rewards toward travel.

We’ll provide more information on specific point valuations below. In some cases, you may get outsized value by transferring your rewards to partnering travel loyalty programs so you can book expensive airfare and/or hotel reservations worth more than 1 cent per point. Travel redemptions and some gift cards are typically worth 1 cent per point. On the low side, points are worth only half a cent each when redeeming as cash back.

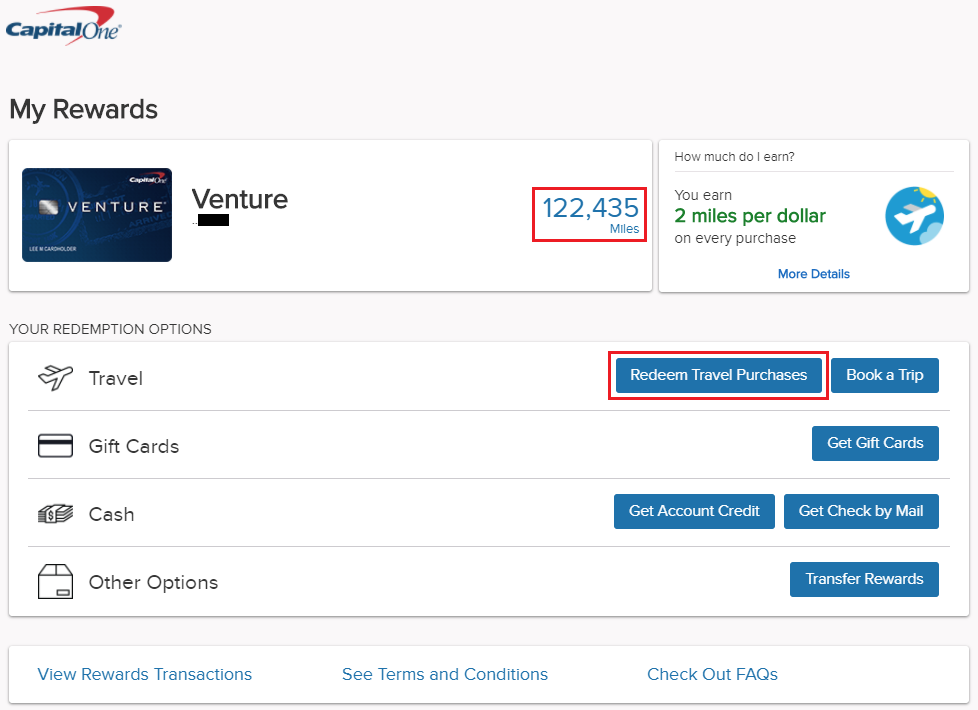

How Much Are Capital One Rewards Points Worth?Ĭapital One rewards points vary in value depending on the type of redemption you choose. This flexibility makes them valuable since you don’t need to commit to a single type of reward in advance. You can optionally convert them to partnering frequent flyer miles, book travel through the Capital One travel center, redeem as cash back or gift cards or select other redemption choices. Since Capital One Rewards are flexible points, cardholders have multiple types of redemptions to choose from. These rewards are added to your account balance until you choose to redeem them. Like all rewards credit cards, you’ll earn Capital One Rewards by making eligible purchases charged to your Capital One card. This can lead to additional redemption options when moving rewards from one card to another as well as allowing you to reach reward goals faster.Įnjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel How Do Capital One Rewards Work? It may also be possible to combine rewards between two or more eligible Capital One cards.

#Capital one venture card free#

No foreign transaction fees, Free employee cards No foreign transaction fees, Credit toward Global Entry or TSA PreCheck, Free employee cards, Credit toward Global Entry or TSA PreCheck application.Ĭapital One Spark Miles Select for Business *Ģ0,000 miles equal to $200 in travel, after spending $3,000 on purchases within the first 3 months from account opening $0 intro for the first year $95 after thatĥ0,000 bonus miles after spending $4,500 on purchases within the first 3 months of account openingĢ miles per dollar on every purchase and 5 miles per dollar on hotels and rental cars booked through Capital One Travel Two visits per year to Capital One Lounges or Plaza Premium LoungesĬapital One VentureOne Rewards Credit Card *ĥ miles per dollar on hotels and rental cars booked through Capital One Travel and 1.25 miles per dollar on every other purchase Up to a $300 annual statement credit toward travel with Capital One, 10,000 annual anniversary points and lounge access at Priority Pass, Plaza Premium and Capital One loungesħ5,000 miles once you spend $4,000 on purchases within 3 months from account openingĥ miles per dollar on hotels and rental cars booked through Capital One Travel and an unlimited 2 miles per dollar spent on other purchasesĬredit toward Global Entry or TSA PreCheck application and benefits mentioned below. Personal Credit CardsĬapital One Venture X Rewards Credit Cardħ5,000 bonus miles after spending $4,000 on purchases within the first three months of account openingĢ miles per dollar on all eligible purchases, 5 miles per dollar on flights booked through Capital One Travel and 10 miles per dollar on hotels and rental cars when booking via Capital One Travel As a bonus, miles post when you earn them, rather than at the end of your statement period. There are no complicated category bonuses to keep straight and no caps on earning. Each card offers different benefits and earning rates so with that many choices, there’s likely to be a card (or two) to fit your personal needs.Īll of the cards offer a straightforward earning structure, where nearly every purchase earns rewards at the same rate (travel bookings made through Capital One travel earn at an enhanced rate).

#Capital one venture card how to#

How To Earn Capital One RewardsĬapital One offers both personal cards and business cards that earn transferable rewards. If that balance of clarity and flexibility sounds up your alley, here’s what you need to know about Capital One miles. Most other programs don’t offer that simplicity. With the right credit card, a customer can get away with a single card in their wallet and still take advantage of strong earnings and a wide variety of redemption options, including some with no strings attached. That’s on top of competitive earning rates, even on cards with no annual fee.īest of all, Capital One Rewards’ array of solutions makes it one of the most straightforward credit card programs available. Capital One miles-previously an indistinct term for something that was essentially cash back-now offer customers numerous redemption options to fit any need.

When it comes to flexible points, Capital One offers a strong rewards program for travelers and non-travelers alike.

0 kommentar(er)

0 kommentar(er)